There’s a reason why it’s called the “silly season”. People do crazy things over the holidays and at Pocketbook, they have the data to back it up.

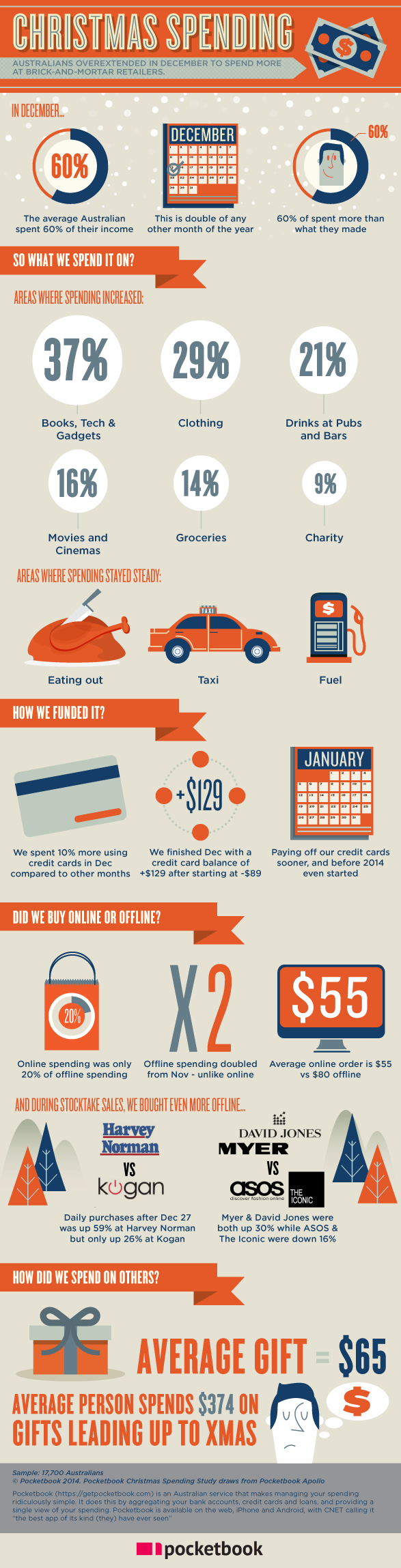

For example, the average Australian spends 30% of their income on discretionary spending (non-bills expenses) on normal days, but during the holidays, that number doubles. Yes, you read that right, doubles – meaning they spend 60% of their income on discretionary spending, and that’s not taking into account the usual bills.

If you didn’t do that, then you’re one of the most frugal people in Australia. According to our study, the majority of us fit into that pattern: 60% have more discretionary spending than income in December too.

Where Did All That Money Go To?

So where do we spend all this money? Did charitable organizations get flooded with money?

Well, sort of. There was a 9% increase in donations. But that pales in comparison to the 37% increase in books, tech & gadgets, 29% on clothing, 21% in buying drinks and 16% watching the movies (damn you Hobbit).

How Did You Finance The Holidays?

So if we spend more than we make during the holidays, does that mean we dipped into our savings?

Well, not exactly (though some might). But on average, we used “the plastic”. Australians get into 10% more debt in December compared to November. Then what we do is pay it off before January – and fortunately, all of it, starting the year with a positive balance.

Who Did You Spend All That Money With?

We make a big deal about how the internet is “going to revolutionise” shopping. That’s true to an extent, but it’s more like an evolution than a revolution.

People still love their stores.

From what we can see, online spend, at least when it comes to the holidays, is only 20% of offline spend. For example, Kogan’s sales (online) is only about 18% of Harvey Norman’s (offline) in November and December. In fashion, the gap is wider still: Asos and The Iconic sales, two of the largest online fashion stores, is only 7% of David Jones’ and Myer’s sales.

People flock to physical stores, with offline retailer’s sales doubling. We also spend more offline ($80 average) than we do online ($55 average). Stocktake activity also sees offline stores driving more activity.

The theory at Pocketbook is that we are shopping for a bargain online, and the internet makes it easier to comparison shop – and shop all year round. People might also be concerned that their gifts won’t be delivered in time.

Stocktake activity also sees offline stores winning. With daily transactions after December 27th up 32% at David Jones and 28% at Myer – in stark contrast to a 16% reduction for ASOS and The Iconic. The story for Harvey Norman and Kogan is similar.

All in all, we spend an average of $374 on gifts leading up to Christmas, with the average gift being $65.

Whatever happened to handmade stuff?

About Pocketbook:

Pocketbook is an Australian service that makes managing your spending ridiculously simple. It does this by aggregating your bank accounts, credit cards and loans, and providing a single view of your spending. Pocketbook is available on the web, iPhone and Android, with CNET calling it “the best app of its kind (they) have ever seen”.

In October 2013, Pocketbook raised $500,000 in angel funding from technology fund Tank Stream Ventures and notable angel investors, including TV and consumer finance personality David Koch; former chairman and chief executive of Investec Bank, Geoff Levy; Dimension Data Australian founder and former CEO David Shein, and SydStart head Peter Cooper.

About the study:

Pocketbook conducted its Christmas Spending study, drawing from the Pocketbook Apollo database – with a sample of 17,700 Australians.

The study is part of an ongoing Consumer Spending Series designed to take an unprecedented look at how Australians spend. For more information see: https://getpocketbook.com/research.